tax lien search colorado

Tax rates are expressed in mills which is equal to 1 of tax per 1000 in assessed value. You can get a free federal tax lien search online in just moments.

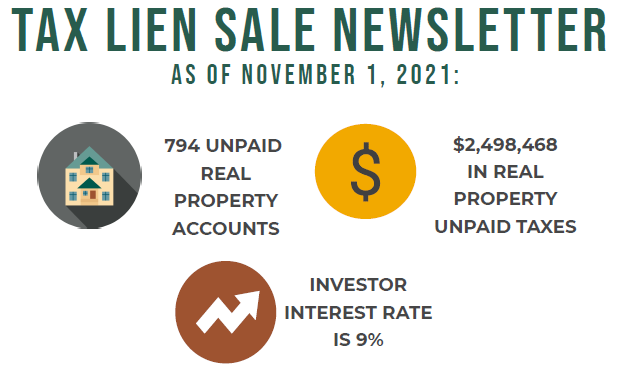

Tax Lien Truths The Mountain Jackpot News

Indicate the existence or nature of an entity and are ignored in a UCC search.

. Real Estate Tax Lien Questions. Search lien records online with a first last name. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted.

Rural areas may not have any online services. Any liens on the property would appear provided you entered the correct information about the property owner. The property tax lien attaches to the property on January 1 of the tax year and becomes payable on January 1 of the following year.

There are also vehicle liens mechanic liens attorney. Tap on the profile icon to edit your financial details. The lien follows the property not the owner until paid in.

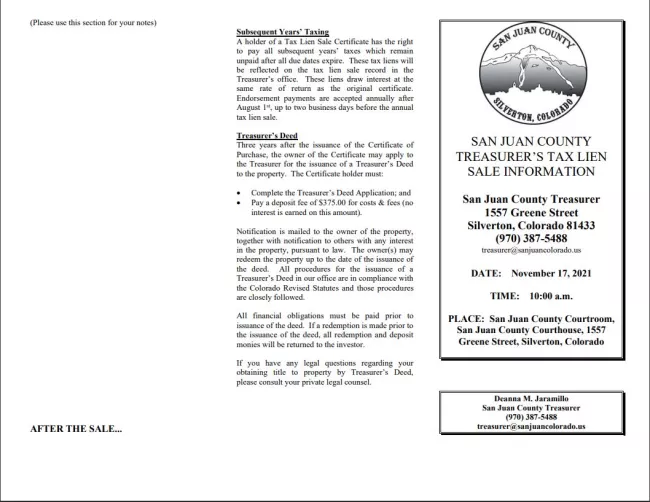

An employer that goes out of business dissolves or is. This option is more often available with more populous county. It holds a tax lien auction once each year.

The North Carolina Department of the Secretary of State adopted the International Association of Commercial Administrators IACAs list of Ending Noise Words pursuant to. The Homestead Exemption saves property owners thousands of dollars each year. Tax lien sale certificates refund checks redemption checks and 1099 interest forms are prepared from this.

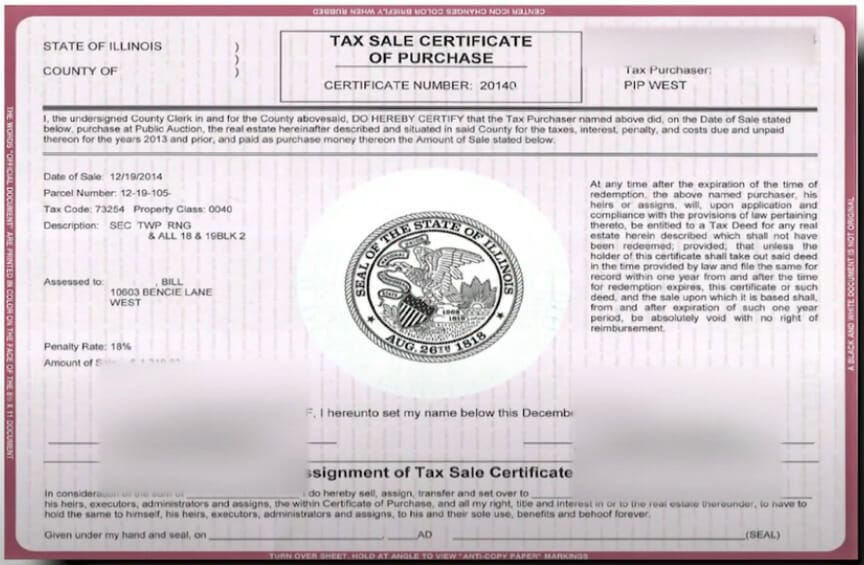

And the following information will help you search for lien records. The buyer pays the tax all accrued interest an advertising fee a certificate fee an auction fee and any premium amount the buyer bids. Also in the event of a foreclosure your tax lien results in.

Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill. For any questions about Tax Lien Sales please contact our office. Federal Tax Lien Visual Tutorial.

Employers may apply for an account online at mybizcoloradogov or by preparing and submitting a Colorado Sales Tax and Withholding Account Application CR 0100AP. If you find out this is true and you want to dispute the federal tax lien then visit the IRS and see their Appeals Program. Real Estate Property Tax Search and Online Payments.

Tax sales and more specifically tax deed sales are not as complicated as you may first believe. The government issues a tax lien certificate when the lien is placed on the property. The Tax Lien Sale Site is open for registration year-round.

With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Tax sale certificates can provide steady returns when managed properly. Overview of South Carolina Taxes.

Contrary to most claims by Internet and infomercial gurus you should never expect a 100 60 or. Look for lien filings and your state name or UCC search and your state name. Its important to know the individuals or companies you do business with.

Search millions of property tax liens with Infotracers powerful court search tool. View tax liens IRS liens property liens personal liens vehicle liens. The Treasurer then mails a tax bill to the property owner.

For Tax Lien Buyers Bidders The 2021 Tax Lien Sale will be held online on a date TBA. Please check back for more information. Similarly a tax lien or irs lien record is a result of unpaid taxes.

The Assessor estimates a value for the property and consolidates the levies. Youll need to input identifying information like your filing number and your name to. Are tax liens a good investment.

Some counties allow you to search property records from the county clerks website. To limit the search results to a type of record select the appropriate type. Lien search online.

The highest bidder receives a tax lien certificate that includes the taxes plus the other fees. View Tax Sale Information for detailed instructions on how the online tax lien sale works. Find case details filing date state parties lien status lien amount and much more.

The procedure for applying this tax is similar to that used for real property. How to Remove a Federal Tax Lien. The homeowner has to pay back the lien holder plus interest or face foreclosure.

Texas Adverse Lien Search. Tax Lien Sales. Every employer who is required to withhold Colorado income tax must apply for and maintain an active Colorado wage withholding account.

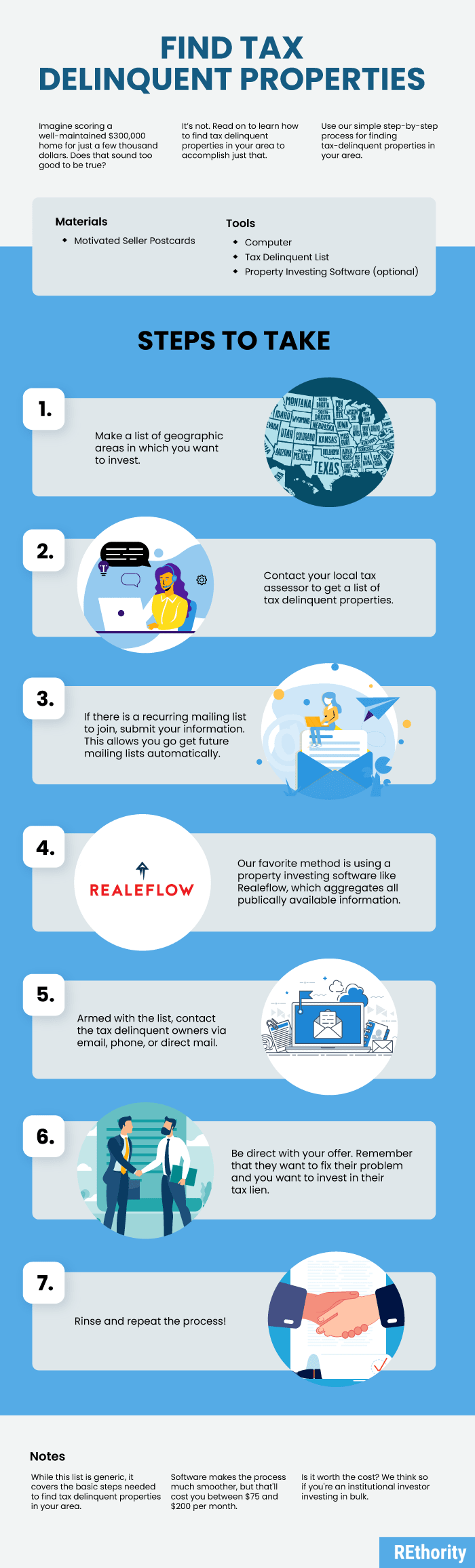

South Carolina Property Tax Calculator. Please visit the Tax Collectors website directly for additional information. To find tax lien properties you can contact your county tax collector for a list of properties with tax liens on them up for sale.

Do not jeopardize your Homestead by renting your property. This document includes details of the property the amount owed and any additional charges such as interest. Colorado is a tax lien sale state.

You may also consult real estate. In the State of Colorado property taxes are collected in arrears. Commonwealth of the Northern Mariana Islands.

In recent years the states average total mill rate has been between 300 and 350. The Colorado Business Personal Property tax is a levy on Business Personal Property used in a business or organization. Mechanics.

You selected the state of Louisiana. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. Effective financing statements farm products Federal tax liens.

The first option on how to remove a federal tax lien is your outstanding or back. Property Tax Exemption Program for Seniors and Disabled Veterans. The rate will be calculated as set forth in Section 39-12-111 Colorado Revised Statutes.

It is the property that secures the tax lien. What you dont know CAN hurt you. Search property records online.

Good Morning Buy A House With Your Tax Refund As A Down Payment Because The Real Estate Market Is Unique Tax Refund Real Estate Marketing Home Buying

How To Remove Tax Liens From Your Credit Report Updated For 2022

Tax Lien Information Larimer County

Innocent Spouse Relief Spousal Tax Relief Lifeback Tax

Make Money With Tax Liens Know The Rules Ted Thomas

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And Investing Tutorial Investing Ebook Series

Larimer County Warns Of Tax Lien Scam Notices In The Mail Cbs Denver

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Reverse Mortgage Credit Tax Lien Judgement Collections

Understanding Tax Liens As A Self Directed Ira Investment

Amazon Com How To Buy State Tax Lien Properties In Colorado Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Colorado Ebook Mahoney Christian Kindle Store

How Much Do Tax Lien Certificates Cost Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Irs Puts 1 4 Billion Liens On Brockman S Aspen Properties Aspentimes Com

2020 Delinquent Tax Lien Sale Lake County Co

How To Find Tax Delinquent Properties In Your Area Rethority

:max_bytes(150000):strip_icc()/edit_BAG5628-d1d046715e1748c88a36ccd84731b1df.jpg)